This means that you can reduce your selling price to $12 and still cover your fixed and variable costs. This means that $15 is the remaining profit that you can use to cover the fixed cost of manufacturing umbrellas. Also, you can use the contribution per unit formula to determine the selling price of each umbrella. In conclusion, we’ll calculate the product’s contribution margin ratio (%) by dividing its contribution margin per unit by its selling price per unit, which returns a ratio of 0.60, or 60%.

- Fixed expenses do not vary with an increase or decrease in production.

- For every additional widget sold, 60% of the selling price is available for use to pay fixed costs.

- For example, in sectors with high fixed costs, such as those with hefty capital investments or sizable research and development expenditures, a higher contribution margin ratio may be needed to achieve viability.

Formula and Calculation of Contribution Margin

Variable costs are not typically reported on general purpose financial statements as a separate category. Thus, you will need to scan the income statement for variable costs and tally the list. Some companies do issue contribution margin income statements that split variable and fixed costs, but this isn’t common.

Is the Contribution Margin Ratio a good measure of profitability?

Direct materials are often typical variable costs, because you normally use more direct materials when you produce more items. In our example, if the students sold 100 shirts, assuming an individual variable cost per shirt of $10, the total variable costs would be $1,000 (100 × $10). If they sold 250 shirts, again assuming an individual variable cost per shirt of $10, then the total variable costs would $2,500 (250 × $10).

The Formula and Result

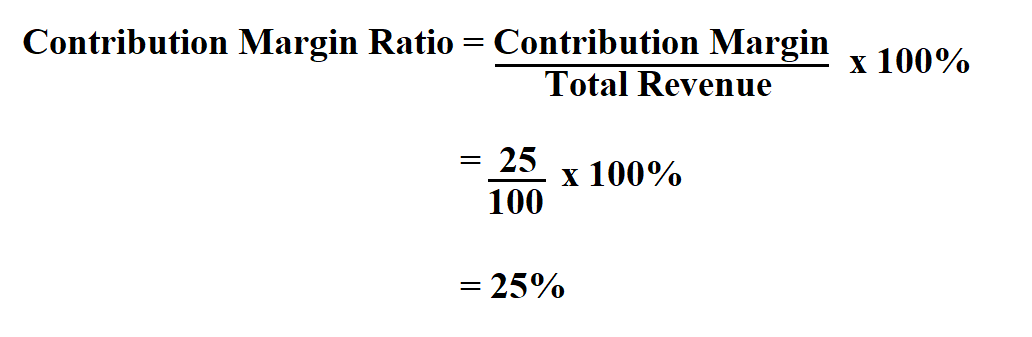

The Contribution Margin Ratio is the product revenue remaining after deducting all variable costs, expressed on a per-unit basis. Knowing how to calculate contribution margin allows us to move on to calculating the contribution margin ratio. To get the ratio, all you need to do is divide the contribution margin by the total revenue. Investors and analysts may also attempt to calculate the contribution margin figure for a company’s blockbuster products. For instance, a beverage company may have 15 different products but the bulk of its profits may come from one specific beverage. Investors and analysts use the contribution margin to evaluate how efficient the company is at making profits.

Total Cost

Other reasons include being a leader in the use of innovation and improving efficiencies. If a company uses the latest technology, such as online ordering and delivery, this may help the company attract a new type of customer or create loyalty with longstanding customers. In addition, although fixed costs are riskier because they exist regardless of the sales level, once those fixed costs are met, profits grow. All of these new trends result in changes in the composition of fixed and variable costs for a company and it is this composition that helps determine a company’s profit.

How is contribution margin calculated?

If they send nine to sixteen students, the fixed cost would be $400 because they will need two vans. We would consider the relevant range to be between one and eight passengers, and the fixed cost in this range would be $200. If they exceed the initial relevant range, the fixed costs would increase to $400 for nine to sixteen passengers. You pay fixed expenses regardless of how much you produce or sell. It includes the rent for your building, property taxes, the cost of buying machinery and other assets, and insurance costs. Whether you sell millions of your products or 10s of your products, these expenses remain the same.

This assessment ensures investments contribute positively to the company’s financial health. With a contribution margin of $200,000, the company is making enough money to cover its fixed creative accounting definition costs of $160,000, with $40,000 left over in profit. To convert the contribution margin into the contribution margin ratio, we’ll divide the contribution margin by the sales revenue.

In these examples, the contribution margin per unit was calculated in dollars per unit, but another way to calculate contribution margin is as a ratio (percentage). The contribution margin ratio is the difference between a company’s sales and variable costs, expressed as a percentage. This ratio shows the amount of money available to cover fixed costs. It is good to have a high contribution margin ratio, as the higher the ratio, the more money per product sold is available to cover all the other expenses. Contribution margin analysis also helps companies measure their operating leverage. Companies that sell products or services that generate higher profits with lower fixed and variable costs have very good operating leverage.