As a result, your variable expenses will go down and your contribution margin ratio will go up. Contribution margin ratio is the difference between your business’s sales (or revenue) and variable expenses for a given time period. As the name suggests, contribution margin ratio is expressed as a percentage. The CVP relationships of many organizations have become more complex recently because many labor-intensive jobs have been replaced by or supplemented with technology, changing both fixed and variable costs. For those organizations that are still labor-intensive, the labor costs tend to be variable costs, since at higher levels of activity there will be a demand for more labor usage.

Step 1 of 3

Variable Costs depend on the amount of production that your business generates. Accordingly, these costs increase with the increase in the level of your production and vice-versa. This means the higher the contribution, the more is the increase in profit or reduction of loss. In other words, your contribution margin increases with the sale of each of your products.

The Formula and Result

It is important to note that this unit contribution margin can be calculated either in dollars or as a percentage. To demonstrate this principle, let’s consider the costs and revenues of Hicks Manufacturing, a small company that manufactures and sells birdbaths to specialty retailers. This means that the production of grapple grommets produce enough revenue to cover the fixed costs and still leave Casey with a profit of $45,000 at the end of the year. Once you’ve calculated your contribution margin, use this number in conjunction with your total fixed expenses for the given time period to calculate net profit or net loss. The addition of $1 per item of variable cost lowered the contribution margin ratio by a whopping 10%. You can see how much costs can affect profits for a company, and why it is important to keep costs low.

- It can also be an invaluable tool for deciding which products may have the highest profitability, particularly when those products use equivalent resources.

- Do these labor-saving processes change the cost structure for the company?

- Let’s say we have a company that produces 100,000 units of a product, sells them at $12 per unit, and has a variable costs of $8 per unit.

- Instead of doing contribution margin analyses on whole product lines, it is also helpful to find out just how much every unit sold is bringing into the business.

Ready to Level Up Your Career?

In this way, contribution margin becomes an important factor when calculating your break-even point, which is the point at which sales revenue and costs are exactly even ($0 profit). This, in turn, can help you make better informed pricing decisions, but break-even analysis won’t show how much you need to cover costs and make a profit. The contribution margin income statement separates the fixed and variables costs on the face of the income statement. This highlights the margin and helps illustrate where a company’s expenses. Variable expenses can be compared year over year to establish a trend and show how profits are affected. The contribution margin represents how much revenue remains after all variable costs have been paid.

This \(\$5\) contribution margin is assumed to first cover fixed costs first and then realized as profit. In our example, if the students sold \(100\) shirts, assuming an individual variable cost per shirt of \(\$10\), the total variable costs would be \(\$1,000\) (\(100 × \$10\)). If they sold \(250\) shirts, again assuming an individual variable cost per shirt of \(\$10\), then the total variable costs would \(\$2,500 (250 × \$10)\). If the total contribution margin earned in a period exceeds the fixed costs for that period, the business will make a profit. If the total contribution margin is less than the fixed costs, the business will show a loss.

Would you prefer to work with a financial professional remotely or in-person?

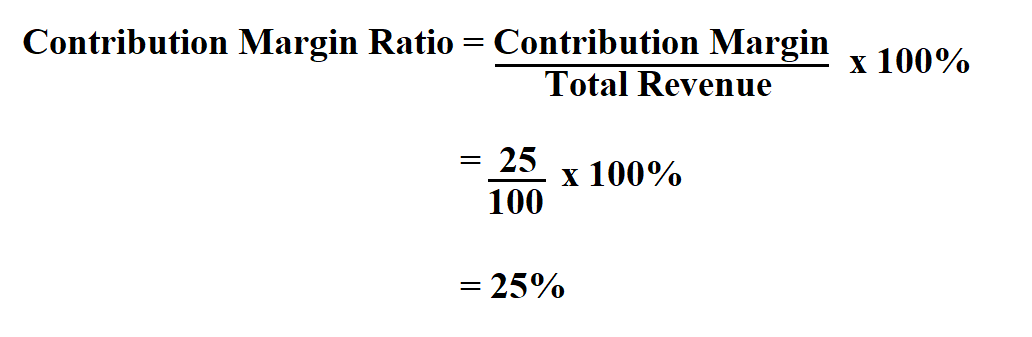

In fact, we can create a specialized income statement called a contribution margin income statement to determine how changes in sales volume impact the bottom line. The contribution margin ratio is a formula that calculates the percentage of contribution margin (fixed expenses, or sales minus variable expenses) relative to net sales, put into percentage terms. The answer to this equation shows the total percentage of sales income remaining to how to calculate fixed cost cover fixed expenses and profit after covering all variable costs of producing a product. The Contribution Margin Ratio is a measure of profitability that indicates how much each sales dollar contributes to covering fixed costs and producing profits. It is calculated by dividing the contribution margin per unit by the selling price per unit. For the month of April, sales from the Blue Jay Model contributed \(\$36,000\) toward fixed costs.

Sales revenue refers to the total income your business generates as a result of selling goods or services. Furthermore, sales revenue can be categorized into gross and net sales revenue. Fixed costs are the costs that do not change with the change in the level of output. In other words, fixed costs are not dependent on your business’s productivity. Furthermore, an increase in the contribution margin increases the amount of profit as well. Furthermore, it also gives you an understanding of the amount of profit you can generate after covering your fixed cost.

For variable costs, the company pays $4 to manufacture each unit and $2 labor per unit. You need to calculate the contribution margin to understand whether your business can cover its fixed cost. Also, it is important to calculate the contribution margin to know the price at which you need to sell your goods and services to earn profits. Similarly, we can then calculate the variable cost per unit by dividing the total variable costs by the number of products sold. The contribution margin ratio, often abbreviated as “CM ratio”, expresses the residual profits generated from each unit of product sold, once all variable costs are subtracted from product revenue. It provides one way to show the profit potential of a particular product offered by a company and shows the portion of sales that helps to cover the company’s fixed costs.