It provides insight into the relationship between fixed and variable costs and their impact on profitability. High DOL indicates that a small percentage change in sales can lead to a significant change in operating income. The Degree of Operating Leverage (DOL) is a financial ratio measuring the change in the operating income of a company to a change in sales.

How Operating Leverage Can Impact a Business

This information shows that at the present level of operating sales (200 units), the change from this level has a DOL of 6 times. As said above, we can verify that a positive operating leverage ratio does not always mean that the company is growing. Actually, it can mean that the business is deteriorating or going through a bad economic cycle like the one from the 2nd quarter of 2020.

Great! The Financial Professional Will Get Back To You Soon.

There are several formulas to calculate the degree of operating leverage, but if we look closely, they just follow the mathematical logic. And the irony of the situation is that there is a tiny margin to adjust yourself by cutting fixed costs in demand fluctuations and economic downturns. Investors can access a company’s risk profile by analyzing the degree of operating leverage. The cost structure directly impacts all the other measures, including profitability, response to fluctuations, and future growth. This formula can be used by managerial or cost accountants within a company to determine the appropriate selling price for goods and services.

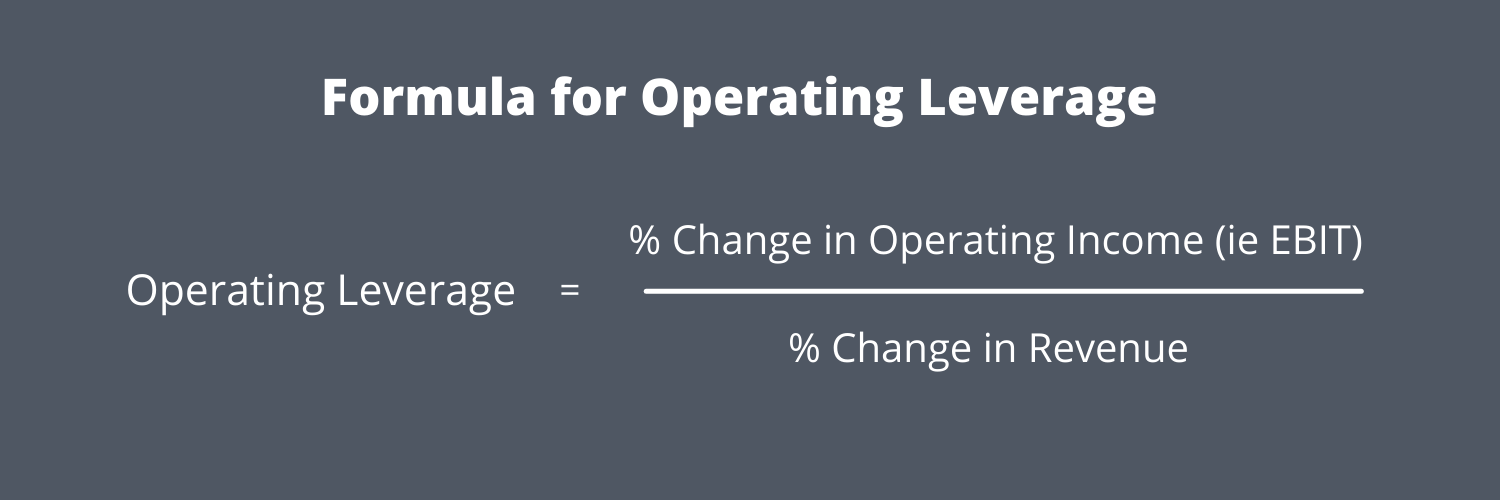

Operating Leverage Formula

- The more profit a company can squeeze out of the same amount of fixed assets, the higher its operating leverage.

- It does this by measuring how sensitive a company is to operating income sales changes.

- It provides insight into the relationship between fixed and variable costs and their impact on profitability.

- By contrast, a retailer such as Walmart demonstrates relatively low operating leverage.

- This increases risk and typically creates a lack of flexibility that hurts the bottom line.

But companies with a lot of costs tied up in machinery, plants, real estate and distribution networks can’t easily cut expenses to adjust to a change in demand. So, if there is a downturn in the economy, earnings don’t just fall, they can plummet. Variable costs decreased from $20mm to $13mm, in-line with the decline in revenue, yet the impact it has on the operating margin is minimal relative to the largest fixed cost outflow (the $100mm).

A high DOL means that a company’s operating income is more sensitive to sales changes. The higher the DOL, the greater the operating leverage and the more risk to the company. This is because small changes in sales can have a large impact on operating income. During the 1990s, investors marveled at the nature of its software business.

Yes, industries that are reliant on expensive infrastructure or machinery tend to have high operating leverage. For example, airlines have high operating leverage because the cost of carrying an additional passenger on a plane is quite low. Much of the price of a restaurant meal is in the ingredients and labor, meaning they’ll have low operating leverage. In contrast, a company with relatively low degrees of operating leverage has mild changes when sales revenue fluctuates. Companies with high degrees of operating leverage experience more significant changes in profit when revenues change.

We will also see the calculation of the degree of operating leverage for an alternative formula considered an ideal calculation method. Variable costs the better way to record prepayment amortisation in xero vary with production levels, such as raw materials and labor. Fixed costs remain constant regardless of production levels, such as rent and insurance.

From an outside investor’s perspective, this is the easier formula for degree of operating leverage. This is actually caused by the “amplifying effect” of using fixed costs. Even if sales increase, fixed costs do not change, hence causing a larger change in operating income. If sales revenues decrease, operating income will decrease at a much larger rate. At the same time, a company’s prices, product mix and cost of inventory and raw materials are all subject to change.