Furthermore, another important distinction lies in how the vast majority of a clothing retailer’s future costs are unrelated to the foundational expenditures the business was founded upon. One notable commonality among high DOL industries is that to get the business started, a large upfront payment (or initial investment) is required. Companies with higher leverage possess a greater risk of producing insufficient profits since the break-even point is positioned higher. For both the numerator and denominator, the “change”—i.e., the delta symbol—refers to the year-over-year change (YoY) and can be calculated by dividing the current year balance by the prior year balance and then subtracting by 1. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader.

- Analyzing operating leverage helps managers assess the impact of changes in sales on the level of operating profits (EBIT) of the enterprise.

- Furthermore, from an investor’s point of view, we will discuss operating leverage vs. financial leverage and use a real example to analyze what the degree of operating leverage tells us.

- These calculators are important because as critical as it is to know how the business is doing, the price you are paying for a part of the company is also important.

- The first idea is matching the economic growth of the economy in which the company resides.

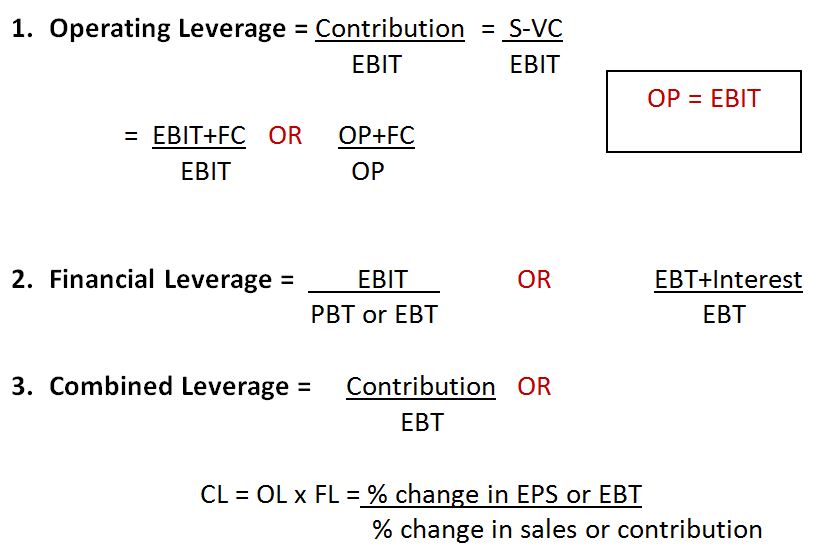

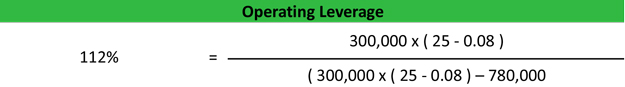

Operating Leverage Formula

For example, airlines have high operating leverage because the cost of carrying an additional passenger on a plane is quite low. Much of the price of a restaurant meal is in the ingredients and labor, meaning they’ll have low operating leverage. As stated above, in good times, high operating leverage can supercharge profit.

Free Financial Modeling Lessons

Other company costs are variable costs that are only incurred when sales occur. This includes labor to assemble products and the cost of raw materials used to make products. Some companies earn less profit on each sale but can have a lower sales volume and still generate enough to cover fixed costs. For example, if a company sells $10 and its operating margin is 50%, its operating profit is $5. But if the company’s sales grow to $20 and the operating margin remains the same, then the company’s profits will scale correspondingly to $10. However, if the company has operating leverage and the operating margin falls to 40%, then the company’s operating profit would grow to $12.

What Is the Difference Between DOL and Financial Leverage?

We tend not to use this formula because it requires the Fixed Costs for the company, and most large/public companies do not disclose this number (see above). This formula is the easiest to use when you’re analyzing public companies with limited disclosures but multiple years of data. But if a consulting firm bills clients for 1,000 hours vs. 100 hours, their expenses would be ~10x higher because they would need to pay their employees for 10x the hours. Microsoft could sell 50,000 copies of Windows or 10 million copies, and their expenses would be almost the same because it costs very little to “deliver” each copy.

What Does the Degree of Operating Leverage Indicate?

If sales and customer demand turned out lower than anticipated, a high DOL company could end up in financial ruin over the long run. As a result, companies with high DOL and in a cyclical industry are required to hold more cash on hand in anticipation of a potential shortfall in liquidity. However, if revenue declines, the leverage can end up being detrimental to the margins of the company because the company is restricted in its ability to implement potential cost-cutting measures.

The airline industry, with “high operating leverage,” has performed terribly for most investors, while software / SaaS companies, which also have “high operating leverage,” have made many people wealthy. This approach produces 2.0x for the software company vs. 1.0x for the services company, which understates the operating leverage differences. For example, software companies tend to have high operating leverage because most of their spending is upfront in product development.

The degree of operating leverage (DOL) is a multiple that measures how much the operating income of a company will change in response to a change in sales. Companies with a large proportion of fixed costs (or costs that don’t change with production) to variable costs (costs that change with production volume) have higher levels of operating leverage. The DOL ratio assists analysts in determining the impact of any change in sales on company earnings or profit. A high degree of operating leverage provides an indication that the company has a high proportion of fixed operating costs compared to its variable operating costs. It also means that the company can make more money from each additional sale while keeping its fixed costs intact. As a result, fixed assets, such as property, plant, and equipment, acquire a higher value without incurring higher costs.

However, companies rarely disclose an in-depth breakdown of their variable and fixed costs, which makes usage of this formula less feasible unless confidential internal company data is accessible. The capital structure of a company goes a long way toward determining the operating leverage of the company. For example, a company with a high debt load also has a high-interest expense on the income statement.

Operating leverage is a cost-accounting formula (a financial ratio) that measures the degree to which a firm or project can increase operating income by increasing revenue. A business that generates sales with a high gross margin and low variable costs has high operating leverage. The biggest idea to understand is that what is bookkeeping operating leverage measures any changes in operating profit related to revenue changes. If a company’s sales grow, but its operating income grows at the same pace, its operating leverage is low, and vice-versa. Even if sales increase, fixed costs do not change, hence causing a larger change in operating income.

Variable costs decreased from $20mm to $13mm, in-line with the decline in revenue, yet the impact it has on the operating margin is minimal relative to the largest fixed cost outflow (the $100mm). From Year 1 to Year 5, the operating margin of our example company fell from 40.0% to a mere 13.8%, which is attributable to $100 million fixed costs per year. The direct cost of manufacturing one unit of that product was $2.50, which we’ll multiply by the number of units sold, as we did for revenue. Upon multiplying the $2.50 cost per unit by the 10mm units sold, we get $25mm as the variable cost. In our example, we are going to assess a company with a high DOL under three different scenarios of units sold (the sales volume metric).