Furthermore, another important distinction lies in how the vast majority of a clothing retailer’s future costs are unrelated to the foundational expenditures the business was founded upon. For instance, a pharmaceutical drug manufacturer must spend significant amounts of capital to even get a drug designed and have a chance of receiving approval from the FDA, which is a very costly and time-consuming process. One notable commonality among high DOL industries is that to get the business started, a large upfront payment (or initial investment) is required. Companies with higher leverage possess a greater risk of producing insufficient profits since the break-even point is positioned higher. If you have the percentual change (period to period) of EBIT, put it here. Finally, it is essential to have a broad understanding of the business and its financial performance.

What Is the Difference Between DOL and Financial Leverage?

The main examples of fixed costs include rent, depreciation, salaries, and interest on loans. The impact of fixed cost is significant as it reduces the financial flexibility of the company and makes it difficult to respond to the changes in demand. In other words, operating leverage is the measure of fixed costs and their impact on the EBIT of the firm. Operating leverage and financial leverage are two very critical terms in accounting. Both tools are used by businesses to increase operating profits and acquire additional assets, respectively.

What is the approximate value of your cash savings and other investments?

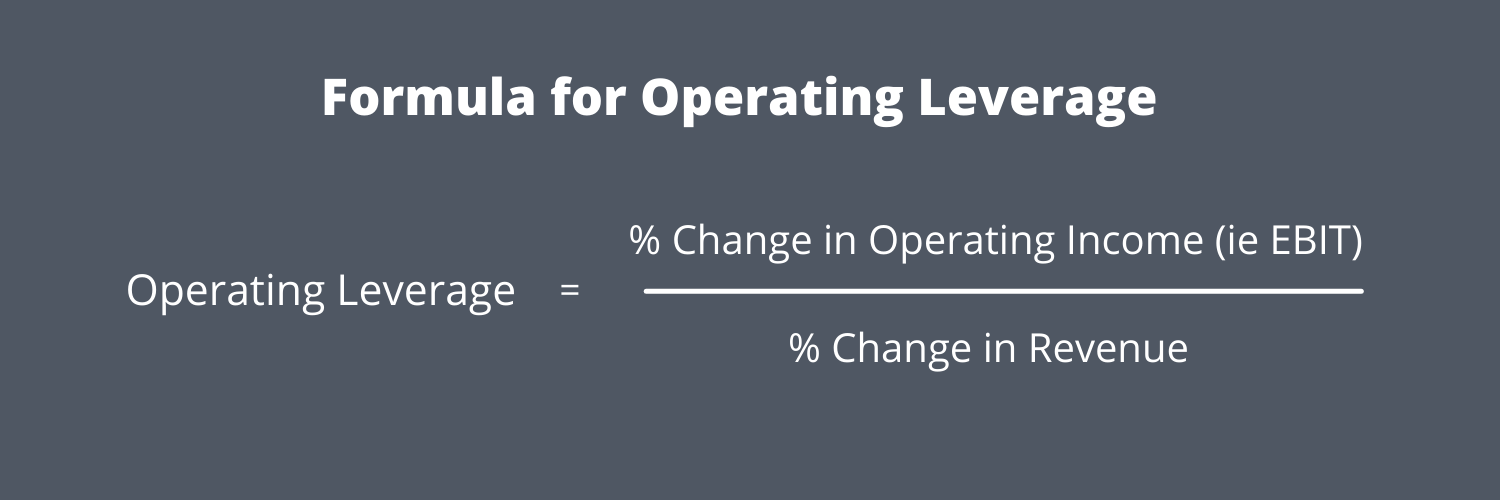

To calculate the degree of operating leverage, you will need to know the company’s sales, variable costs, and operating income. The Degree of Operating Leverage (DOL) indicates how sensitive a company’s operating income is to changes in sales volume. The degree of combined leverage measures the cumulative effect of operating leverage and financial leverage on the earnings per share. When the company makes more investments in fixed costs, the increase in revenue does not affect the fixed costs.

What are the limitations of using DOL?

Without a good understanding of the company’s inner workings, it is difficult to get a truly accurate measure of the DOL. Conversely, Walmart retail stores have low fixed costs and large variable costs, especially for merchandise. Because Walmart sells a huge volume of items and pays upfront for each unit it sells, its cost of goods sold increases as sales increase. Operating leverage is a cost-accounting formula (a financial ratio) that measures the degree to which a firm or project can increase operating income by increasing revenue. A business that generates sales with a high gross margin and low variable costs has high operating leverage. If you have a small business, you must calculate the degree of operating leverage to maintain the bookkeeping of transactions.

InvestingPro offers detailed insights into companies’ Degree of Operating Leverage (DOL) including sector benchmarks and competitor analysis. Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. Starting out, the telecom company must incur substantial upfront capital expenditures (Capex) to enable connectivity capabilities and set up its network (e.g., equipment purchases, construction, security implementations). The catch behind having a higher DOL is that for the company to receive positive benefits, its revenue must be recurring and non-cyclical.

Real Company Example: Operating Leverage

- If sales revenues decrease, operating income will decrease at a much larger rate.

- In contrast, degree of operating leverage only considers the sales side.

- However, in DOL, the derived proportion of sales only works with a limited range, which may become a problem.

- An operating leverage under 1 means that a company pays more in variable costs than it earns from each sale.

For example, for a retailer to sell more shirts, it must first purchase more inventory. When a restaurant sells more food, it must first purchase more ingredients. The cost of goods sold for each individual sale is higher in proportion to the total sale. For these industries, an extra sale beyond the breakeven point will not add to its operating income as quickly as those in the high operating leverage industry. Although revenues increase year-over-year, operating income decreases, so the degree of operating leverage is negative.

When the firm has fixed costs, the percentage change in profits due to changes in sales volume is greater than the percentage change in sales. With positive (i.e. greater than zero) fixed operating costs, a change of 1% in sales produces a change of greater than 1% in operating profit. The Degree of Operating Leverage (DOL) is a financial metric that measures understanding percentage completion and completed contracts how a company’s operating income (EBIT) responds to changes in sales volume. It’s like a financial magnifying glass, showing how your fixed and variable costs can amplify changes in sales into larger changes in operating income. If a company has high operating leverage, then it means that a large proportion of its overall cost structure is due to fixed costs.

Even a rough idea of a firm’s operating leverage can tell you a lot about a company’s prospects. In this article, we’ll give you a detailed guide to understanding operating leverage. Understanding DOL allows managers to make informed decisions about pricing, production, and investment by evaluating the potential impact of sales fluctuations on profitability. High operating leverage means that small changes in sales can lead to significant changes in operating income. This can be beneficial when sales are increasing but risky when sales are declining. High operating leverage can be risky for a company in several ways, including reduced flexibility, magnified effects of revenue changes, financial risk, and strategic risk.

Operating leverage is used to determine the breakeven point based on a company’s mix of fixed and variable to total costs. A company with a high DCL is more risky because small changes in sales can have a large impact on EPS. It is therefore important to consider both DOL and financial leverage when assessing a company’s risk. In contrast, degree of operating leverage only considers the sales side. If the company’s sales increase by 10%, from $1,000 to $1,100, then its operating income will increase by 10%, from $100 to $110.

The Operating Leverage measures the proportion of a company’s cost structure that consists of fixed costs rather than variable costs. That indicates to us that this company might have huge variable costs relative to its sales. Similarly, we can conclude the same by realizing how little the operating leverage ratio is, at only 0.02.

A company with high financial leverage is riskier because it can struggle to make interest payments if sales fall. We’ll go over exactly what it is, the formula used to calculate it, and how it compares to the combined leverage. Yes, DOL can be used to compare the operational risk of companies within the same industry, helping investors identify firms with higher or lower financial risk profiles.