So, in the case of an economic downturn, their earnings may plummet because of their high fixed costs and low sales. The benefit that results from this type of cost structure is that, if sales increase, the company’s profits will also increase correspondingly. Analyzing operating leverage helps managers assess the impact of changes in sales on the level of operating profits (EBIT) of the enterprise. Higher DOL means higher operating profits (positive DOL), and negative DOL means operating loss.

- Regardless of whether revenue increases or decreases, the margins of the company tend to stay within the same range.

- As said above, we can verify that a positive operating leverage ratio does not always mean that the company is growing.

- Running a business incurs a lot of costs, and not all these costs are variable.

- Many small businesses have this type of cost structure, and it is defined as the change in earnings for a given change in sales.

Degree of Operating Leverage (DOL)

Young companies struggle to get costs under control as they focus on growing quickly to gain market share and stay alive. Once they achieve maturity and sales level, operating efficiency becomes more important. The higher interest expense creates more volatility in earnings and different values for the company. Debt is a necessary ingredient in a growing business, but the debt load must be in relation to its sales volume.

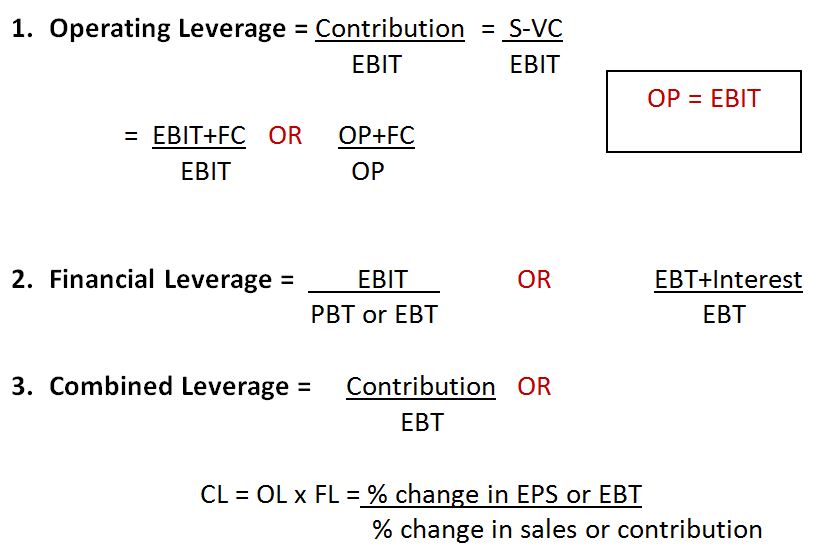

Operating Leverage Formula

For comparability, we’ll now take a look at a consulting firm with a low DOL. Starting out, the telecom company must incur substantial upfront capital expenditures (Capex) to enable connectivity capabilities and set up its network (e.g., equipment purchases, construction, security implementations). An example of a company with a high DOL would be a telecom company that has completed a build-out of its network infrastructure. The catch behind having a higher DOL is that for the company to receive positive benefits, its revenue must be recurring and non-cyclical. The shared characteristic of low DOL industries is that spending is tied to demand, and there are more potential cost-cutting opportunities. For instance, a pharmaceutical drug manufacturer must spend significant amounts of capital to even get a drug designed and have a chance of receiving approval from the FDA, which is a very costly and time-consuming process.

Operating leverage vs. financial leverage

Financial and operating leverage are two of the most critical leverages for a business. Besides, they are related because earnings from operations can be boosted by financing; meanwhile, debt will eventually be paid back by those increased earnings. Managers need to monitor DOL to adjust the firm’s pricing structure towards higher sales volumes as a small decrease in sales can lead to a dramatic decrease in profits. Since profits increase with volume, returns tend to be higher if volume is increased.

Increasing utilization infers increased production and sales; thus, variable costs should rise. If fixed costs remain the same, a firm will have high operating leverage while operating at a higher capacity. Operating Leverage is a financial ratio that measures the lift or drag on earnings that are brought about by changes in volume, which impacts fixed costs. Many small businesses have this type of cost structure, and it is defined as the change in earnings for a given change in sales.

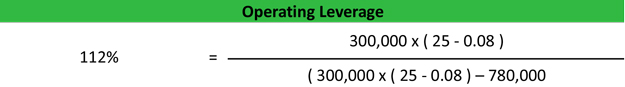

Another way to control this operational expense line item is to reduce unnecessary expenses, especially during slow seasons when sales are low. The operating margin in the base case is 50%, as calculated earlier, and the benefits of high DOL can be seen in the upside case. Since 10mm units of the product were sold at a $25.00 per unit price, revenue comes out to $250mm. A second approach to calculating DOL involves dividing the % contribution margin by the % operating margin. Or, if revenue fell by 10%, then that would result in a 20.0% decrease in operating income. The second idea, industry growth, is the first resource most analysts choose when making sales predictions.

As I mentioned earlier, sales growth is one of the fundamental drivers of value for any company. Still, it is important to realize that sales growth, profit growth, and value creation are unrelated. Emerging markets tend to be the most volatile but flatten out as they mature. A great example is the cell phone industry; early on, there were great sales and competition, but as saturation started to occur, the great growth companies such as Verizon enjoyed flattened out.

You shouldn’t use it to compare a software company to a manufacturing company because their business models are completely different. However, high operating leverage also creates greater risk in some contexts. These calculators are important because as critical as it is to know how the business is doing, the price you are paying for a part of the company is also important.

A company with a high DOL coupled with a large amount of debt in its capital structure and cyclical sales could result in a disastrous outcome if the economy were to enter a recessionary environment. Common examples of industries recognized for their high and low degree of operating leverage (DOL) are described in the chart below. The DOL would be 2.0x, which implies that if revenue were to increase by 5.0%, operating income is anticipated to increase by 10.0%. The first idea is matching the economic growth of the economy in which the company resides. For example, as a base rate, most companies in the U.S. will grow at least at the rate of the economy or GDP, which historically ranges between three to four percent. Before looking at a formula, let’s explore some of the drivers of operating leverage.

The biggest mistake is forecasting high growth rates when the company or industry is in the middle of the life cycle. As the TVs gained more following, the producers added more transfer pricing capacity and accelerated capacity at the top of the S-curve, even as sales flattened. Keep in mind that each industry will have different degrees of operating leverage.

Welcome to the fascinating world of the Degree of Operating Leverage (DOL)! If you’re eager to understand how changes in sales impact your operating income, you’re in the right place. This guide will walk you through the ins and outs of using the Degree of Operating Leverage Calculator, all while keeping things engaging and lighthearted. Regardless of whether revenue increases or decreases, the margins of the company tend to stay within the same range.